The Income Tax Department has set a final deadline for linking your PAN–Aadhaar card. As per the latest update highlighted by The Times of India, failing to complete this process on time can lead to serious financial and compliance issues.

If you haven’t linked your PAN and Aadhaar yet, here’s a complete guide covering deadlines, penalties, steps, and consequences.

❓ Why PAN–Aadhaar Linking Is Important

Linking PAN with Aadhaar is mandatory under Indian tax laws. This integration helps the government curb tax evasion, streamline financial transactions, and ensure accurate identification of taxpayers.

If the linking is not completed within the stipulated time, your PAN will become inoperative, making it unusable for most financial and tax-related activities.

📅 Key Dates and Penalties You Should Know

-

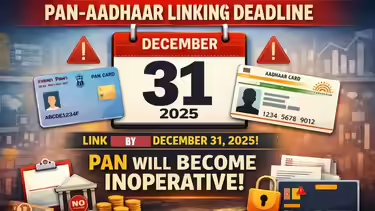

🗓️ Final Deadline: December 31, 2025

-

⛔ PAN Becomes Inoperative: From January 1, 2026

-

💰 Late Linking Fee: ₹1,000

-

✅ Fee Exemption: PANs issued after October 1, 2024, using an Aadhaar enrolment ID

🧾 Step-by-Step Process to Link PAN with Aadhaar

Follow these simple steps to complete the linking process online:

-

🌐 Visit the Income Tax e-Filing Portal

-

📂 Navigate to the Linking Option (Profile → Link PAN with Aadhaar)

-

✍️ Enter Required Details (PAN & Aadhaar numbers)

-

💳 Pay the Late Fee via e-Pay Tax

-

🔐 Verify and Submit using OTP

-

🔍 Validation by UIDAI (status updates in 24–48 hours)

🔎 How to Check PAN–Aadhaar Linking Status

💻 Online Method

-

Visit the e-filing portal

-

Click on “Link Aadhaar Status”

-

Enter your PAN and Aadhaar details

📲 SMS Method

Send an SMS to 567678 or 56161 in the following format:

⚠️ Consequences of an Inoperative PAN

If your PAN becomes inoperative, you may face several challenges:

-

🚫 Unable to file income tax returns

-

⏳ Pending refunds will not be processed

-

📈 Higher TDS and TCS deductions

-

🏦 Issues in opening bank accounts

-

📉 Restrictions on investments and financial transactions

🛠️ What If Your PAN and Aadhaar Details Don’t Match?

If linking fails due to mismatched details such as name or date of birth, take the following steps:

-

🆔 Correct Aadhaar Details: Visit the UIDAI portal

-

🪪 Correct PAN Details: Update via Protean (NSDL) or UTIITSL

-

🧬 Biometric Verification: Visit an authorized PAN service center if online correction fails

📝 Final Thoughts

With the December 31, 2025 deadline approaching, it’s best to complete the PAN–Aadhaar linking process at the earliest. A linked PAN ensures uninterrupted access to banking, investments, and tax services while helping you avoid penalties and higher tax deductions.